Know Your Numbers

Jason Moore Mar 16, 2022 12:25:31 AMShare this article:

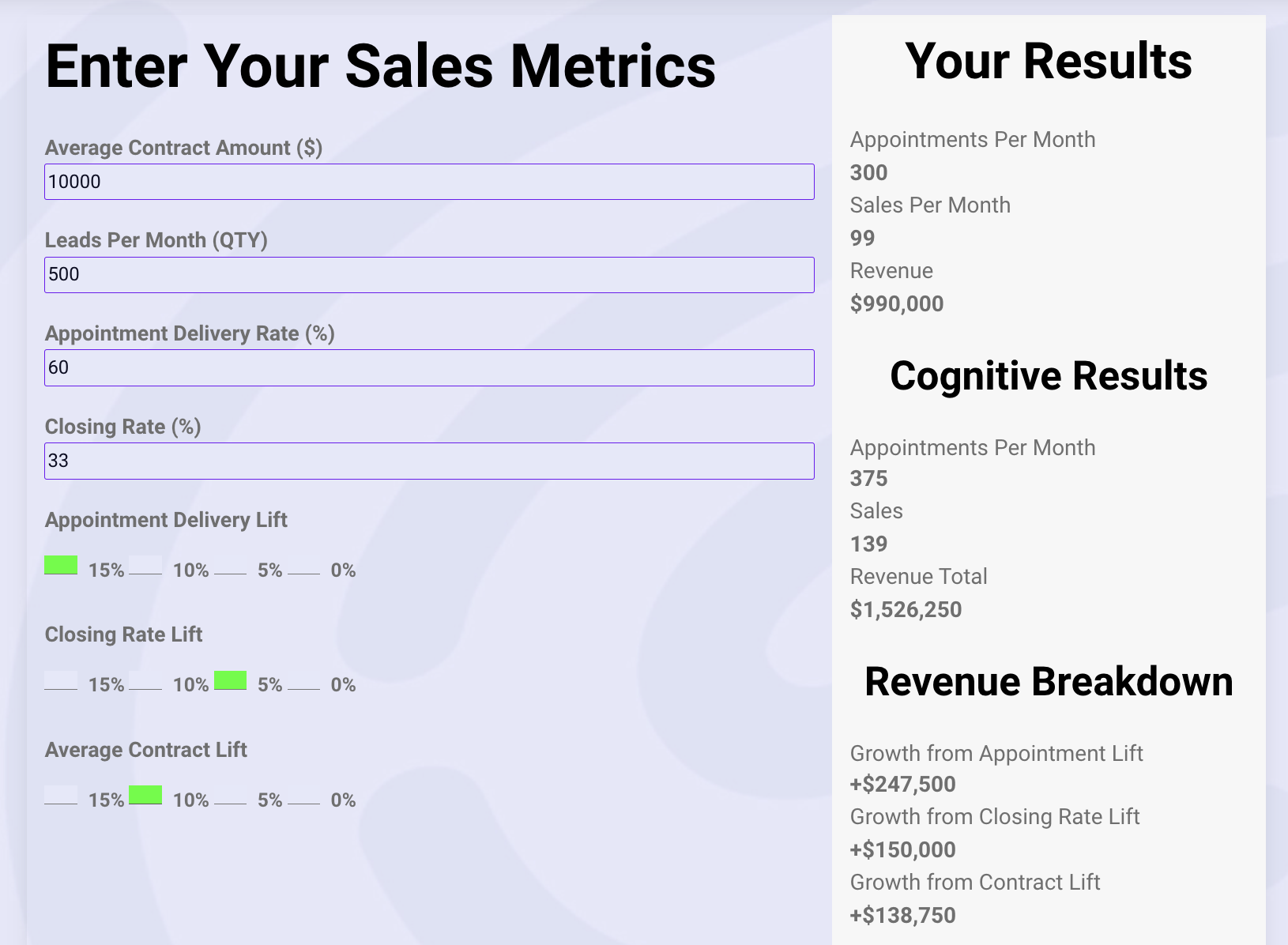

Knowing your numbers leads to an understanding of your metrics that will directly impact the sales and marketing strategies you implement in order to grow revenue at your company. Along with our Sales Calculators, this article will help you understand the value of a few key metrics and explain some of the immediate steps you can take to lift your profits, all without buying more leads.

Leads Per Month

How many leads come in each month? Think about your business. On average, how many leads per month do you get? Does everyone know their numbers? You might be surprised how many sales teams do not. Your leads could be from canvassing, from lead aggregators like Home Advisor, from paid marketing campaigns, organic leads from social, or leads from direct referrals. In order to understand the performance of your lead sources and the effectiveness of your sales team, sum up your leads per month and we’ll take a look at some of the key metrics you should be using and how they will inform your sales and marketing strategy.

Closing Rate

What is your closing rate? How many leads convert into sales? It depends on your business, your industry, your sales process, and the amount of training you do for your people. Most of my clients over the years have been residential roofing contractors and I’d say that the average closing rate, taking into account all lead sources, is about 33%. For the industry, that’s a healthy conversion percentage.

Lead Aggregators

When the objective is to grow sales, a lot of people will just go buy more leads. Consider that this may not necessarily be the best strategy. If you have an established market and you are buying leads from an aggregator but you're only closing 13%, you may want to focus on improving your closing rate because really low conversion is a big problem. Now, don’t get me wrong. I love aggregators like Home Advisor. When you want to expand and open a new market, buying aggregated leads is the easiest and most predictable way to at least get something started. You have to understand how to best utilize lead aggregators as a tool and it is up to you to leverage it in your business in the right way.

Appointment Delivery

How can I grow revenue without buying more leads? What is the first thing you want to focus on? The answer is converting appointments (appointment delivery) because that is where you get the most revenue lift. If you can increase your conversion of leads to appointments, you are going to automatically increase your bottom line. The problem for some contractors is the lack of process. When a new lead comes in, you call them but maybe you don’t call right away. Perhaps they don’t answer and you hang up. Then, a week later maybe you think about it again and if you get them on the phone, it’s too late. They’ve already signed with someone else. There are other companies that when a lead comes in, it goes directly into their CRM. From there, it automatically sends a text message and an email to the lead to set the appointment. Maybe it also pings a rep in their call center in real time, who is now calling the homeowner within seconds of receiving the lead. If you are one of the contractors who has not had success with lead aggregators, this could be the reason. Your competition may be so automated and so quick to confirm the appointment with shared leads, that every other contractor in your market has no chance of getting the appointment. Don’t be discouraged though. Most lead aggregators can integrate with a lot of different CRM’s. So, if you are using a CRM, then there is no reason why you shouldn’t have automated responses set up when a new lead comes in or when someone interacts with your business. Doing so should be an urgent focus and will immediately increase your leads to appointments.

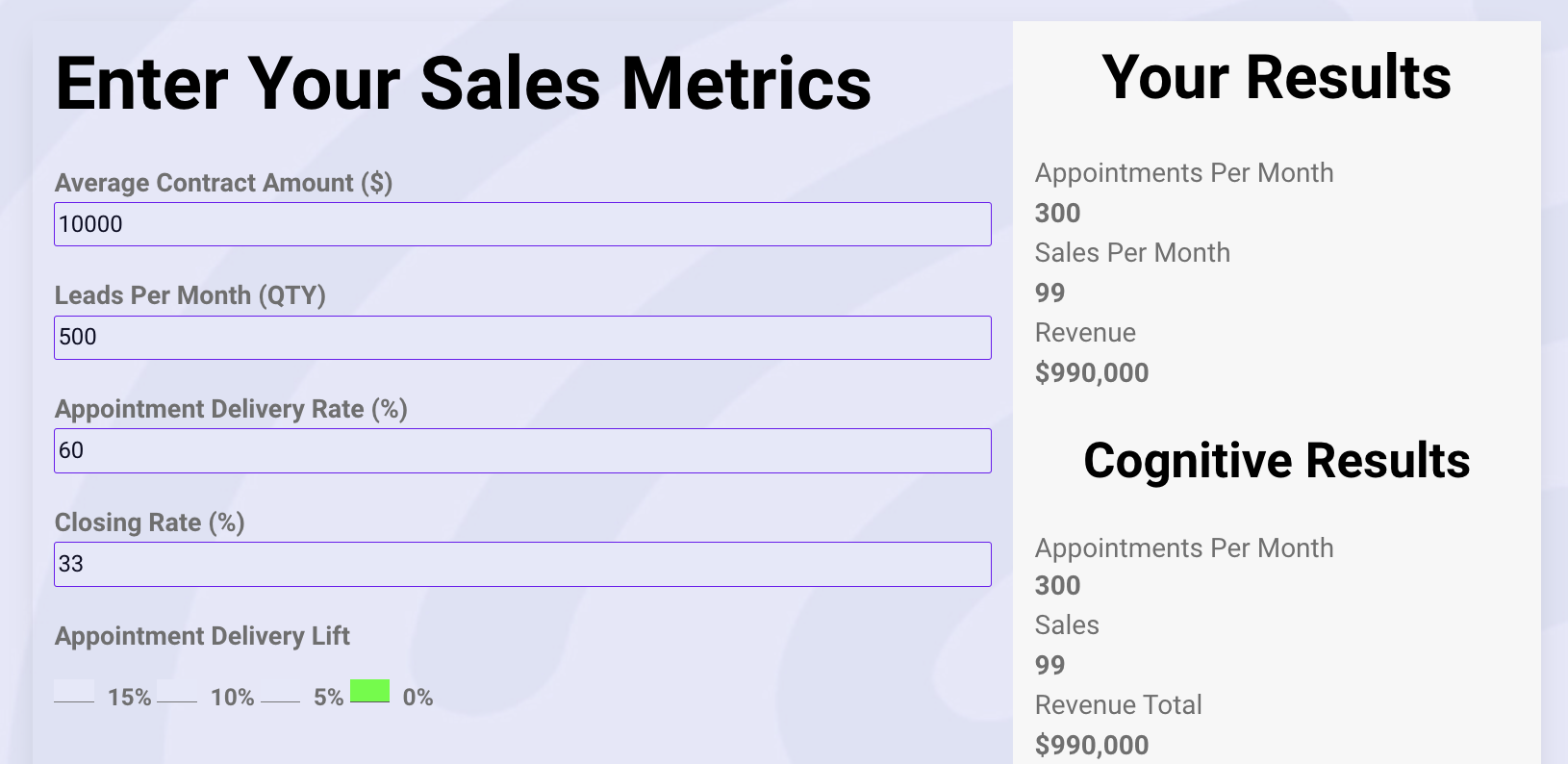

What is it going to do if you make some process changes and increase your conversion to appointments? In the example below, let’s use some typical values. I’ll set the average contract amount at 10K and use the industry closing rate of 33% that I mentioned above. We’ll assume 500 leads per month where 60% of them convert to an appointment.

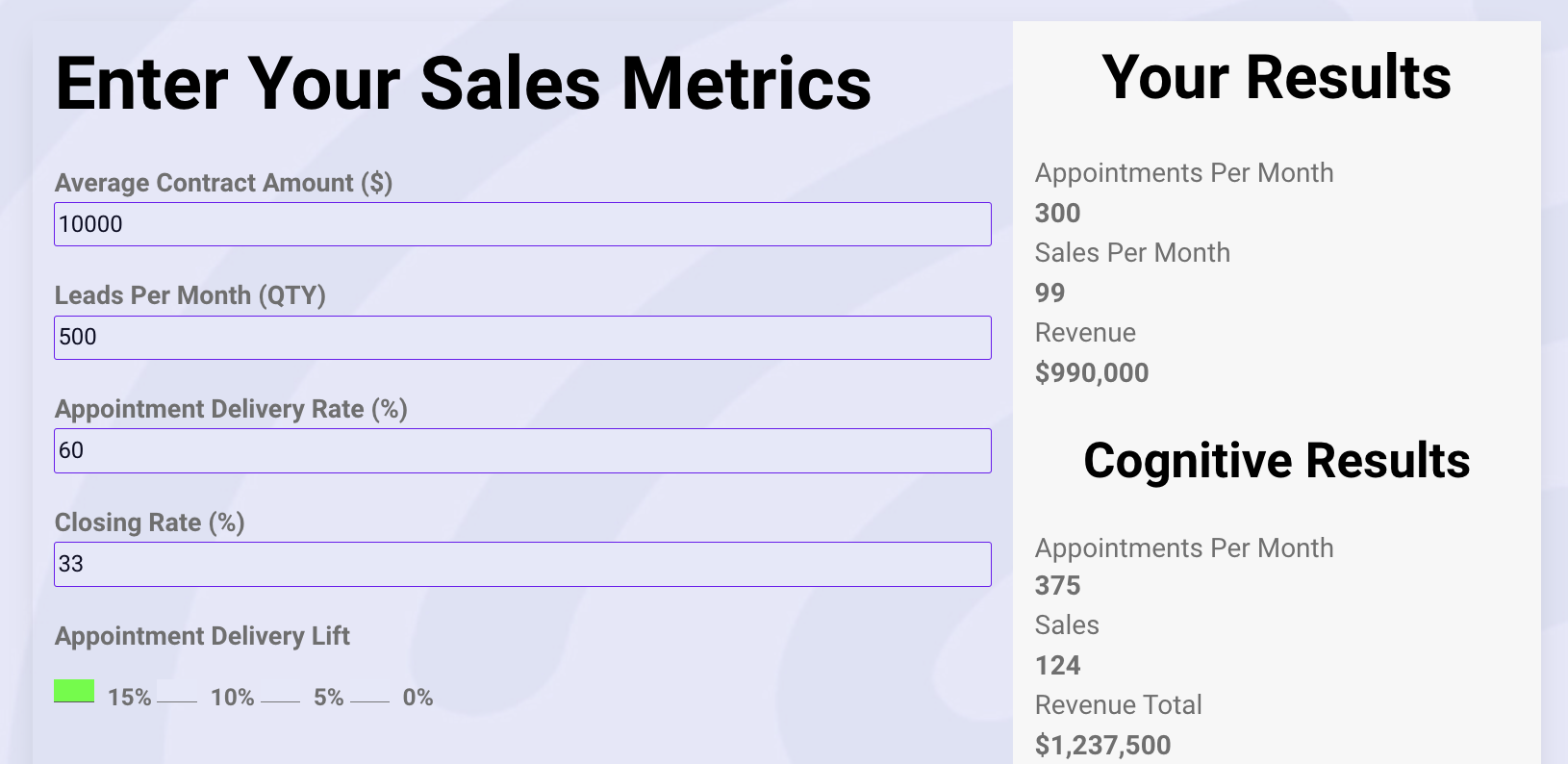

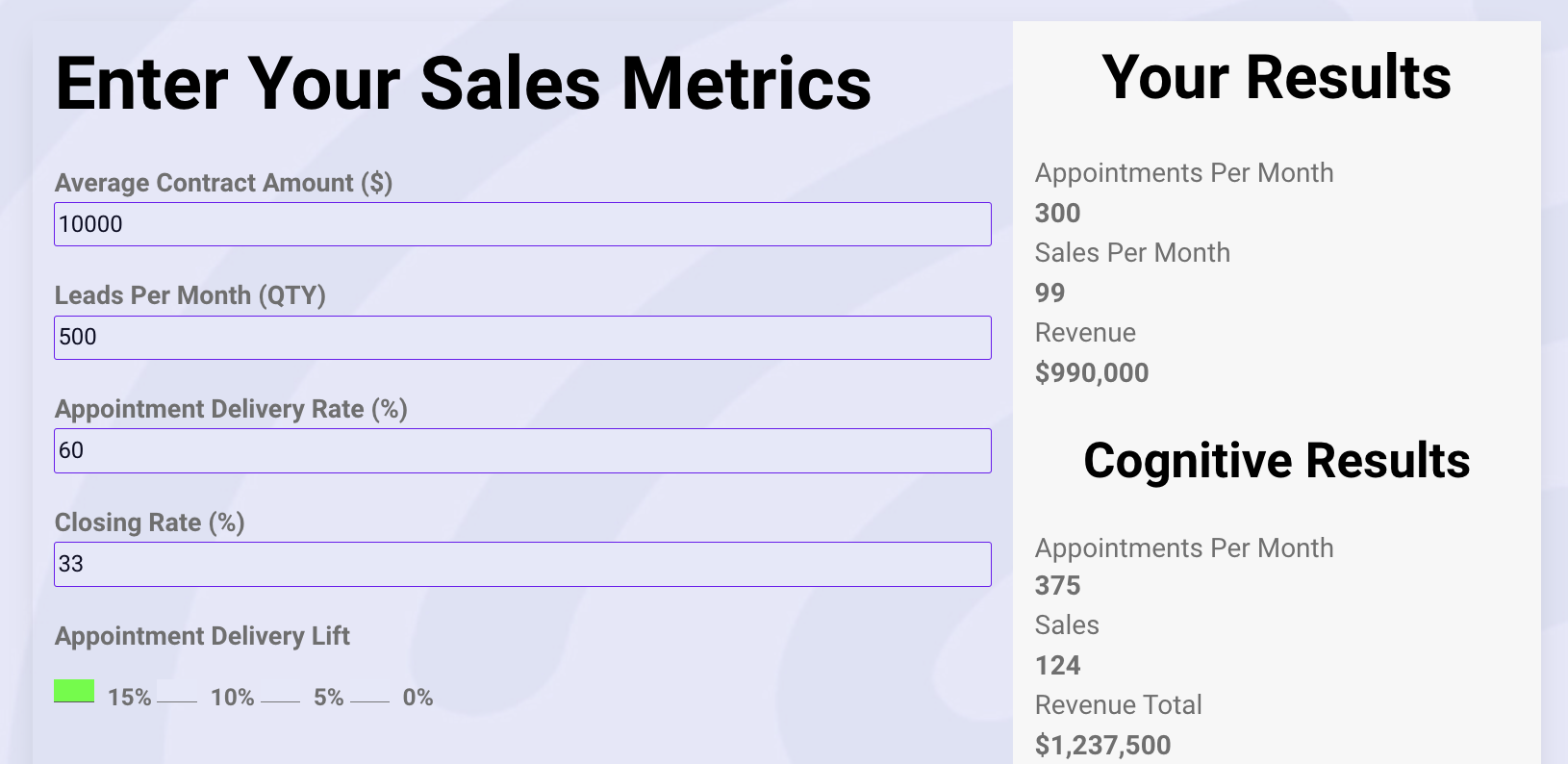

Monthly revenue at these levels comes out to $990,000. If you focus more time and attention on converting leads into appointments, you could realistically see an Appointment Delivery increase of 15%. So, let’s see how revenue is impacted with an Appointment Delivery of 75%.

What happened? You made more money. That’s the goal, right? Without spending more on leads or increasing your marketing budget, you have increased revenue by 25%. Let’s recap. We started at $990,000 and with a 15% rise in Appointment Delivery, revenue became $1,237,500. This is an increase of $247,500 per month.

Closing Rate - Revisited

Our CEO, Josey Parks was speaking at the IRE when he asked the audience, “Does anyone have any really awesome ideas for closing appointments?” Someone shouted, “show up” and the audience roared. That’s a pretty good response. You definitely need sales reps who are dedicated and take their job seriously, along with a culture that would never permit that kind of no show. It’s funny-sad though because we all know that it happens far too often.

Picture this. Every time you get an appointment, your system sends them an email with a link to a profile of the rep that is coming out. It has a picture and a short bio that includes hobbies or interests, things that the prospect might connect with. Maybe it even includes a short video of the rep making a pleasant introduction. At the same time as the email goes out, a direct mail piece, like a trifold brochure, is posted to the lead’s home. An elaborate process? Perhaps, but when your rep arrives, there is immediate rapport and brand recognition. Positive rapport with a homeowner is going to make the appointment so much easier to close and brand recognition is going to keep your retention rates high by minimizing cancellations after the contract’s been signed. Strategies like this, when applied across your entire sales team, will make a substantial difference to your average closing rate.

What else? What is the most important thing you can do to increase the average closing rate for your sales team? Train, train, train, train. That’s right. Regular sales training is a must. Get sales consultants. Hire professionals to come in. Go to events. Go to sales training bootcamps. Develop a sales culture of closers. Does this seem like a lot of work? Yes. It is a lot of work but let’s look at the impact. What kind of difference would this effort mean to your business? Last time we calculated the numbers, we used the industry average of 33% closing rate.

If you explore and implement the strategies above as well as guide and develop a culture of closers, you can realistically expect to see your average closing rate increase by at least 5%. So, let’s see what revenue becomes with a 38% average closing rate.

Amazing! Another $150,000 in monthly revenue, a 15% increase over where we began.

Average Contract Amount

What does it take to increase your average contract amount? Easy right? Upsell with additional trades and higher-end products. I would imagine that all of you are already doing this and if you are not, it is probably because you have recognized and focused on the trades that you do well. Let’s say that you are a roofing contractor. You sell composition shingles to residential homeowners. Projects are always completed in one day. Customers are happy and your average GM is over 40%. When you add on other trades, however, the job becomes complicated, the margin suffers, and sometimes it just isn’t worth it. Does this sound familiar to anyone?

Many of you have figured out how to expand your product offering and keep margins high while expertly producing the project and keeping customers pleased throughout. All that being said, prospects will ultimately buy what they can afford (or what they can finance.) Your reps are unlikely to upsell and grow the average contract amount overall unless you target higher-end homes and wealthier prospects.

One way to do this (if you’re not already) is to target your lead gen efforts based on the size of the home. Now, let’s talk about this for a minute. For paid advertising campaigns, are you targeting solely based on geography (residents within a specific radius of your office or within a storm swath?) Are your lead gen efforts (direct mail, cold calls, or canvassing) excluding small homes? If not, why not? Maybe you don’t have access to that data. Well, good news. The data is out there and is much more abundant than you would imagine.

What I am describing here is called a Filtered Model. This is when a contractor, knowing which homeowners they prefer, decides to filter based on a number of attributes that can be determined by buying data on every household in their market. Then, they exclude every home that does not fit the minimum threshold for each attribute. The number one filtered attribute for every residential contractor is owner-occupied. This eliminates all of the renters. Imagine, never again sending out a sales rep to an appointment only to find out that the current resident is a renter. That alone is going to provide a nice little boost to your closing rate. The next most popular attribute is square footage of home, which is a good indicator of the financial position of the owners. If you’re not targeting your lead gen efforts already, start small. Start with these two attributes and stop wasting marketing dollars and your sales rep’s precious time. Once you’ve dialed in some targeting on a small scale and you’ve seen the results for yourself, set up a time to meet with my team at Cognitive Contractor and we can show you how to take it to a whole other level using data science and artificial intelligence.

Depending on your market, current average contract amount, and the level of targeting you may already be doing, I’m pretty confident that you can increase your average contract amount by 10%. So, if your average contract amount is similar to our example, 10K, then some basic targeting will get you up to 11K. Let’s see how a 10% lift impacts revenue.

Worth it! That’s an increase of $138,750 in monthly revenue or a 14% increase over where we started. You’ve probably noticed the overlapping lift from these three areas produces an exponential result. The revised monthly revenue total is now $1,526,250, a total increase of $536,250 and almost 57% in total revenue growth.

Let’s have a quick look at the annual results. A company with $990,000 in average monthly revenue is at $11,880,000 per year. Let’s assume a conservative gross margin of 35% and that comes out to $4,158,000 in gross profit. Now, a company that has implemented changes and reached the monthly revenue goal of $1,526,250 will achieve $18,315,000 in annual revenue and $6,410,250 in gross profit. Amazing. Think you can do it? Need some help? Get in touch with me and my team.

Share this article: